Market Insights: Investment Wines

Wine: A Passion Asset

The 2008 financial crisis, market volatility and record low interest rates over the past decade has prompted investors to diversify their investments and move into areas of non-financial physical assets, particularly those that have intrinsic value, where supply is limited. Under this umbrella falls ‘collectibles’ or ‘passion assets’, which include among other things, items such as fine wine, art, classic cars, jewelry and antiques. Collectibles typically offer no income stream to which traditional valuation techniques can be applied. While their primary purpose is for the collector’s enjoyment, they are nonetheless playing an increasing role in the alternative investment landscape.

From a collector’s perspective, unique qualities, limited supplies and the thrill of owning a sought after physical object make passion assets attractive, and as Coutts private bank acknowledges, their investment performance is often difficult to ignore. Figures reported in their 2017 Object of Desire Index—which includes 15 passion assets across two broad categories, trophy property and alternative investments (broken down into fine art, collectibles and precious items)—show investments in these combined categories rose an impressive 76.6% from 2005, when the index first began. Likewise, the Knight Frank 2019 Luxury Investment Index showed significant growth across nearly every Objects of Desire item class, with fine wine investments up 9% for FYE 2018, and overall 147% in the last 10 years. Additionally, their Wealth Report indicates that >68% of the respondents to its annual Attitudes Survey were increasingly interested in collecting investments of passion.

Source: Knight Frank 2019 Wealth Report.

This article focuses on collecting fine wine as an alternative investment and the various factors new collectors should consider before getting started. Though we may enjoy drinking wine, investing in it isn't necessarily a good idea for everyone. However, for sophisticated investors seeking to diversify their portfolio, fine wine may offer attractive opportunities for consistent, increasing returns. In addition to having low correlation to traditional financial markets, and with an extended period of compound annual growth rates between 10-20%, the fine wine market has provided strong risk adjusted returns over the medium- to long-term. Typically though, as David Sokolin, author of Investing in Liquid Assets, states, “to see meaningful returns you need to invest ≥$10,000 or more. The rarer the wine, the better the investment. Rare wines appreciate over time because they are finite, decreasing in quantity and chased by a global clientele,” for example, sought-after vintages like a 1961 Bordeaux are hard to acquire. So instead, Sokolin suggest investors seeking Bordeaux wines focus on “vintages from 1982, 1990, 2000, 2005, 2009 and 2010, where better opportunities to collect may lie.”

The Value of Wine

Well beyond the simplicity of a fine wine from a reputable producer being heralded a good vintage, many other factors affect the value of wine. Business insights, statistical data and price transparency are publicly available and have evolved to where collectors of all levels can participate in the market. But what determines value? Collectors should understand the following criteria to be a minimum benchmark by which to evaluate a wine’s value and investment potential, and upon which to base purchasing decisions. While the degree of importance may vary, all are vital in formulating the basis of investment merit. These factors are used by most respectable wine investment firms, who combine both quantitative and qualitative analysis, to determine where there may be opportunities to buy an undervalued wine, or one that is in line for price growth, etc. By understanding how each of the criteria impacts a wine’s price evolution, they can determine which wines are best suited to a specific investor’s portfolio. In no particular order, those major valuation factors Include:

• Brand & Producer History

• Quality & Production

• Score & Scheduled Re-scores

• Market Supply & Demand

• Historical price performance

• Comparative price analysis

• Market trends

• Drinking window

Investment Grade Wines

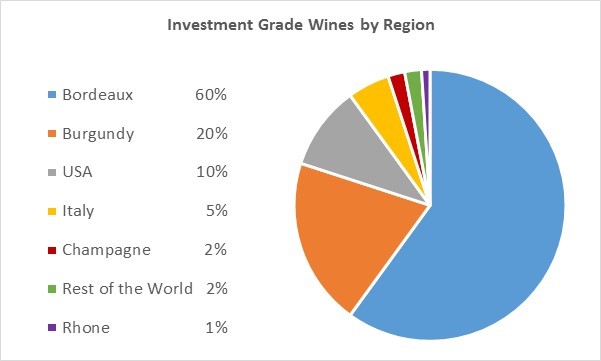

The major valuation factors help determine if a wine is worthy of investment.Investment-grade wines come from regions all over the world, but those deemed ‘fine wine’ are subject to strict controls. Regulations vary by country but are generally enshrined in law, with some classifications dating well over 100 years.

Source: Cult Wines

Liv-Ex and Other Indices

Liv-ex, also known as the London International Vintners Exchange, is the best-known wine trading platform in the world, providing real-time and historic data and price updates daily. The exchange has over 400 global members of the wine trade, and is known within the industry to provide the most reliable pricing data for valuation purposes, therefore a leading reference point, generating more than £28M worth of bids and offers each day.

Source: Live-Ex.

Other platforms, such as CaveX and Wine Owners, two independent fine-wine trading platforms, are primarily aimed at private customers and typically provide collectors and investors the opportunity to buy and sell their bonded wines from and to each other directly, without having to go through brokers, merchants or auction houses. Depending which way a collector chooses to invest, whether directly, through an intermediary, or via ownership of publicly traded stock, these indices and platforms are yet another way research and track the value of investment grade wines.

Ways to Invest in Fine Wines

There are various ways to invest in fine wine. While seasoned collectors may enjoy the thrill of pursuing and obtaining a particular bottle or case themselves (or through their broker), other options are available to those who prefer a decidedly different approach to collecting and/or investing in fine wine.

Wine Stocks. One way of getting exposure to the wine market is to directly invest in publicly traded stocks or shares of companies in the industry. For example, LVMH Moët Hennessy Louis Vuitton SE owns a number of high profile investment grade wineries including Cheval Blanc, Chateau d’Yquem and Champagne House Krug. With this approach, your investment is a purely financial instrument and will not be directly linked to the underlying tangible asset. Additionally, by buying shares, the investment is correlated to the performance of the financial markets, which could be a downside to direct ownership and at odds with the desire to diversify by owning actual, non-financial assets.

Wine Funds. Investing through a wine fund structure outsources all responsibility for selection of the wine(s) to a fund manager (much like any other exchange trade fund). This saves time and effort, but removes any ability for the investor to tailor a portfolio to his or her needs. With a wine fund, you do not own the underlying asset and are only trading on the value of the market. Depending on where you are domiciled, it may also remove the tax-free element, a benefit of owning the physical wine inventory.

Invest in a Winery. For investors with significant capital, it’s sometimes possible to actually buy into and/or own a winery. In recent years, this method has become increasingly popular with high net worth investors adding wine properties as part of their overall investment portfolios.

Invest in Physical Wine. This approach is the essence of ‘passion asset’ and could provide interesting tax, ownership and structuring advantages due to the easily transferable status of a case of wine. There are two ways an investor/collector can undertake this approach: a) self-manage by choosing and buying wine through a wine merchant (paying a margin), and securing insurance and storage themselves; or, b) use a professional fine wine investment company (paying a management fee) to manage the investment from start to finish, including wine selection, insurance, storage, and sale, etc.

Risks of Investing in Fine Wine

Any investment carries a degree of risk so robust due diligence is needed to understand the full scope of possible pitfalls. A few important risk factors to consider when undertaking fine wine investment includes the following, which is by no means an exhaustive listing.

Unregulated Market. The wine investment market is unregulated and as such falls outside the scope regulating bodies (e.g: Financial Conduct Authority (FCA) in the UK, or Securities Exchange Commission (SEC) in the U.S., etc). Therefore, investors are not protected in the same way that they are when investing in regulated financial products.

Liquidity. While some wealth management firms see value in passion assets as a means to diversify a portfolio, its important to understand that collectibles have especially high unit costs and it typically takes 4-12 weeks to liquidate a sizeable fine wine portfolio. Therefore investors are cautioned not to commit capital to wine investment they might need back more immediately.

Short-term Trends. There are numerous examples of short term trends yielding impressive gains within the fine wine market, but an investment should be viewed as a mid-to long-term one, with a holding period of five years minimum recommended by most wine investment firms.

Misjudged Valuations. Critics argue that, as a result of limited historical risk/return data, passion assets are subjectively valued, making their valuation very difficult and sometimes impossible until the point of sale. Regular valuation of wine holdings is important because it helps to identify the right opportunities to sell, or what represents a good value for growth potential when buying.

Counterfeits. In an effort to defeat counterfeits, some of the most desirable wine brands (for e.g: Château Lafite-Rothschild) have adopted use of the Prooftag system, a technology placed on bottles to trace/validate them upon request. Other anti-counterfeiting resources, such as WineFraud.com (among many others), exists to help educate collectors and authenticate fine wines. Using the services of a reputable company greatly reduces risks of buying counterfeits, but there have been numerous instances of high profile investors/collectors (e.g: Bill Koch) obtaining counterfeit wines from trustworthy sellers (e.g: Christie’s), so the importance of due diligence to verify provenance and authenticity (which is key to resale value) cannot be understated.

Other Considerations Before Investing in Fine Wine

“Know thyself.” This maxim, attributed to the Greek sages, Aeschylus, Socrates and Plato, can be paraphrased to mean ‘know thyself as an investor.’ In other words, collectors should first ask themselves, ‘What type of investor am I,’ ‘What is my risk tolerance,’ ‘Do I like a hands-on or hands-off approach to investing,’ etc. Beyond that, and assuming the preferred method of investing is in the actual underlying physical asset, collectors should take into account these additional considerations before self-managing their wine portfolio, or using an investment company.

Sources for Buying and Selling. There are myriad options, including but not limited to: traditional auction houses (such as Christie’s or Sotheby’s), online auction platforms, investment firms, wine merchants and other trade entities. etc. Unless acquiring directly from the producer, collectors should expect to pay additional fees, such as buyer’s premium, shipping and/or storage, etc. If you are selling indirectly through an auction house or other sales agent, similar fees apply, such as commission, for example. Its important to read and understand the fine print.

Minimum Financial Investment. When using an investment company to manage the wine investment, minimum investment levels often apply, with some recommending a “sweet spot” investment level well above the minimum.

Minimum Bottle Requirement. Most wine auction sites prefer to sell wine in sets of 3, 6, 12 and 13 (the latter is for a collector who wants to try a bottle). Purchasing 3 or more bottles is an opportunity to start collecting verticals of single wine (same wine but different vintages). Some wine exchanges require full cases.

Storage & Security. Professional storage is key. Where and how the wine is stored not only helps safeguard the asset, but contributes to the ability to sell or liquidate at the desire time. Insured, temperature controlled facilities (or government bonded warehouses), as well as state-of-the-art security systems at the facility and for the wine matter greatly. For example, wine stock given exchateau or SIB passport is recognized within the fine wine trade and ensures that the wines were checked for provenance and condition. Inventory management control and tracking also fall under this category, and is typically included in the services of the investment company. For collectors that plan to self-manage, utilizing appropriate inventory management software may be an additional consideration and expense.

Shipping & Insurance. Shipping wine domestically or between countries, without the correct customs advice or paperwork can cause costly delays, and in some cases permanent confiscation of the wine. When insuring wine assets, the deductible, coverage and cost of the policy in relation to the value of the collection are additional financial considerations.

Holding Period. Recommendations vary as it’s not uncommon for investors to make short term gains. If shorter time frames are preferred, Sommelier and Co-founder of Wine Folly, Madeline Puckette, has recommended en premier wines from Bordeaux. However, other factors come into play for holding periods and a general rule of thumb is 6-10 years.

Best Wines and/or Regions to Get Stared. While Bordeaux and Burgundy represent a significant proportion of the wine investment market, other important regions include Italy, Champagne, Rhone, Spain, U.S.A, Australia, Loire, Portugal, and Chile, among a few others. A key diversification objective should be to ensure that wines are included with strong potential growth over the short, medium and long term, while minimizing position risk with a sufficient spread across estates, regions and vintages.

Valuation Reporting & Tax Implications. How the wine is valued for reporting purposes may impact taxes. Tax and accounting implications vary by country, so investors should consult their professional tax advisor on how a collectible asset such as wine might impact their portfolio.

Currency Considerations. For international investors, currency fluctuations, exchange rates and interest rates among other things may also impact portfolio value.

In Conclusion

Getting started with investing in wine is not unlike taking an informed approach to any other financial investment. New collectors should seek unbiased, objective guidance from a variety of sources, and get to know professionals in the wine industry who can further aid their collecting efforts. Then, set realistic wine investment goals. An important collection can be started with as few as 3 bottles, and for the simple act of collecting wine for personal pleasure on a small scale, one need not be a sophisticated investor. If, however, a new collector wants to invest in their passion for financial reasons, then its wise to seek professional advice and guidance. Happy collecting!

Disclaimer. This material has been prepared for informational purposes only and is not intended to provide, nor should it be relied on for tax, legal, accounting, or investment advice. Consult your own financial and legal advisors before engaging in any transaction.

— Christina Spearman